Understanding technology cycles relevance today

Developed Nations Groundhog day – Stuck in the Turning Point.

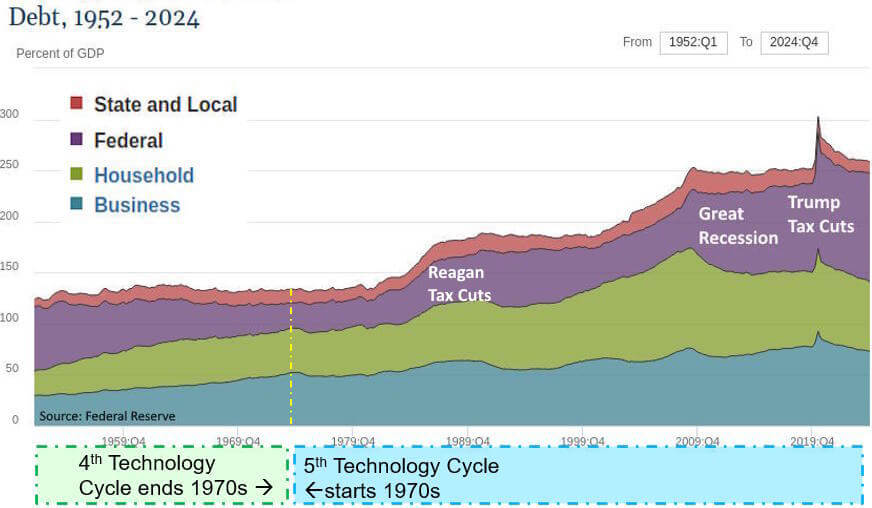

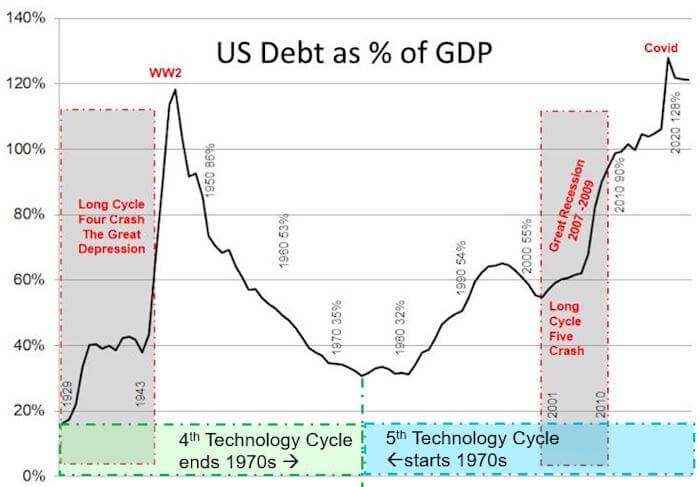

A Forty-Year Debt Experiment Gone Wrong

Since the Reagan era, America has conducted a grand economic experiment: slash taxes for corporations and the wealthy, pile on debt, and wait for prosperity to trickle down. The results are in, and they’re damning:

– Federal debt has ballooned to 25% larger than our entire GDP—exceeding even WWII levels1

– Total debt (federal, state, business, and consumer) now stands at a staggering 3 times more than US total economic output

– GDP growth remains anemic despite unprecedented deficits, spending, and borrowing

– The middle class has been systematically hollowed out under this burden

This debt-fueled approach hasn’t generated authentic growth—it’s created a mirage. Remove big tech profits from the equation, and S&P 500 earnings have remained essentially flat for two decades!

This kind of behavior was understandable when the old line industrial industries fell by the wayside as the fifth technology cycle go underway in earnest. But by the latter 1990s, it had become pretty clear that we were in a new technological paradigm. Typically this is when nations adapt to the new socioeconomic paradigms. Instead the developed nations have become rutted in blaming progressive parties with the technological shift. Currently we have radical conservatives at loggerheads with the progressives. Here’s how how get here.

Debt delivers low / no growth

GDP has even contracted in countries such as Germany and Japan. They did so because they had not responded with extreme national deficit spending to fuel lower growth rates in the wake of the Great Recession. Therefore, we do not know if the economy has grown since 2007 (the Great Recession). It could be purely a delusion due to increasing government debt. We are less than two years away from the 2007 contraction, 20 years ago!

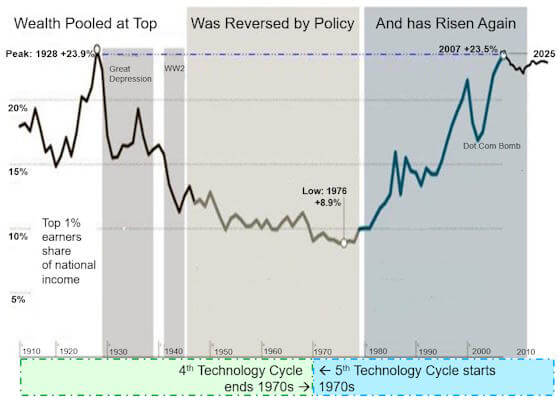

The Vanishing American Middle Class

What truly “made America great” wasn’t the wealth of the 1% or military dominance—it was the unprecedented size and prosperity of its middle class. Today’s reality tells a different story:

– More than half of middle-class Americans live paycheck to paycheck

– Real wages for most workers have stagnated since the late 1970s

– The middle class has been shrinking for decades as wealth concentrates at the top

– Social supports that once bolstered middle-class security have been systematically dismantled

The most devastating impacts have fallen on those working outside technology sectors, where skills become obsolete faster and job security evaporates.

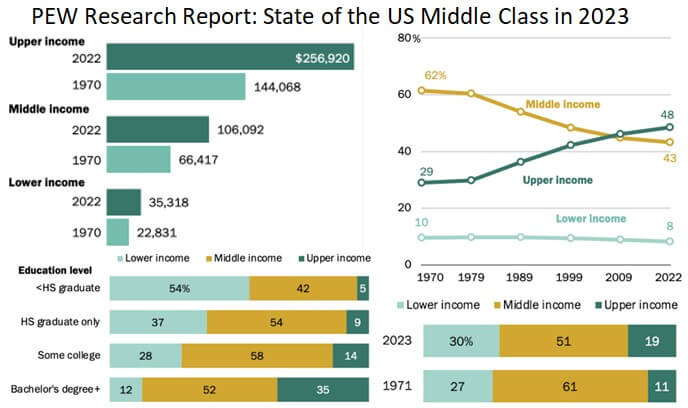

Today, most Americans in the middle class no longer make a “living” wage. See the following chart for the data showing this.

The PEW study explains in more detail why the US middle class is shrinking. And has been for decades. The Link opens in a new tab.

The data paints the picture vividly

The pictorial illustrates that the US middle class made a living wage from 1945 until the late 1970s. Governmental policy supporting the middle class created a system that powered the economy through everything from union support to social security and other social programs in response to the Great Depression. The US and other nations have been systematically dismantling social supports for the middle class since the 1990s. One of the key factors is the middle-class members who do not work in the core technology areas suffer the most. Their skills atrophy the fastest, and those are the people targeted, as they are outside of the application for the core innovations.

Why has the middle-class contraction been invisible?

Since consumer spending makes up 66% of the economy, how is it possible that the US middle class has contracted, and no one has heard about this? The answer is two-fold. First, it is emblematic of our current technology cycle (the microprocessor core ecosystem of innovation). Since few know technology cycle models, the logic is not applied to the current data. The US is stuck in this excruciating transition phase because the middle class is not only financially struggling, but at the same time, they are voting against their self-interests.2 The health of the middle class is paramount for any developed nation.

For a greater understanding of Big Techs contribution to this issue via platform lockin read AI’s essays on this topic.

America’s Diminishing Global Position

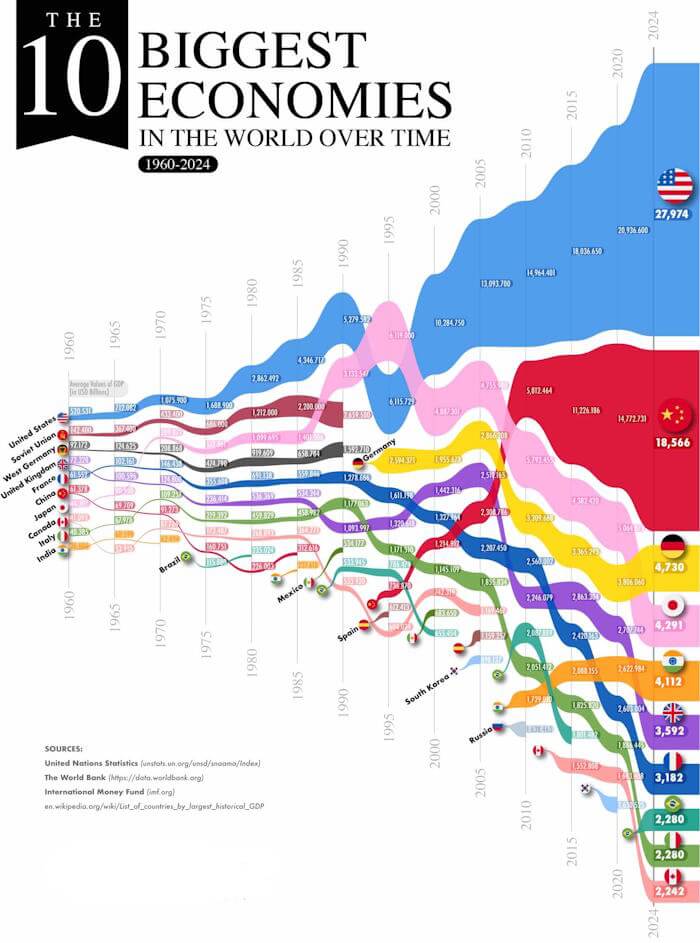

The second factor is that the US led all nations’ production by wide margins through the 4th and the first half of the 5th technology cycles. As shown above, the US is now suffering from a declining global position.

In 1960, the U.S. economy was 11 times larger than the second-place nation (the USSR). Today, it is not even twice the size of China’s, and the gap is getting smaller. If America had maintained its historical trajectory, the US economy would be more than twice as large today.

This decline mirrors Britain’s experience during the third technology cycle, when they too responded with tariffs, scapegoating, and nationalism rather than addressing structural challenges.

“An entire world economy was built on, or rather around, ours. Our economy rose to a position of global influence and power unparalleled by any nation. There was a moment in the world’s history when we could be described as its only workshop, its only massive importer and exporter, its only carrier, and almost its only investor. Therefore, we are the world’s only military power and the only one with a genuine world policy.” This passage was excerpted from British historian Eric Hobsbawm’s introduction to England’s flagging position in his book Industry and Empire.3

As with the US today, the lead of English worldwide dwindled during the third technological cycle. What the British felt was ailing Great Britain reads like words written today in the US. The British imposed tariffs, scapegoated the workforce, and blamed other nations. Sound familiar?

The Path Forward: Rebuilding from the Middle

As former Labor Secretary Robert Reich wisely observed, “The rich do better with a smaller share of a rapidly-growing economy than with a large share of an economy barely growing.”

The solution isn’t found in manufacturing nostalgia or economic nationalism. Real prosperity requires:

1. Relentless focus on rebuilding middle-class economic security

2. Strategic investment in emerging technologies that drive the next cycle

3. Recognition that broadly shared prosperity isn’t just morally right—it’s economically essential

History shows industrialized nations adapt to technological transitions by strengthening their middle class. Those who fail to adjust to the new economic realities, while wealth concentrates at the top, face prolonged decline. The warning signs couldn’t be more apparent.

Robert Reich – exceptional thought leader

I have had the honor of exchanging several emails with the former US Secretary of Labor, Robert Reich—a very kind and brilliant person. “Higher taxes on the wealthy to finance public investments improve future productivity. All of us gain from these investments, including the rich. Broadly shared prosperity isn’t just compatible with a healthy economy that benefits everyone—it’s essential to it. That isn’t crazy left-wing talk. It’s common sense.”4 Sadly, very little common sense is discernible above the din in the current blame-based hysteria in the US.

In his book Aftershock, released in 2011, Robert Reich predicted, “When the nation’s economy foundered in 2008, blame was directed almost universally at Wall Street. But he suggested a different reason for the meltdown and the perilous road ahead. Reich argued that the real problem is structural: it lies in the increasing concentration of income and wealth at the top and in a middle class that has had to go deeply into debt to maintain a decent standard of living.” Given what happened in the decade since he wrote these words, his thinking is nothing short of prophetic!

This is why understanding technology cycles is so crucial. Once understood, different economic approaches are required at other times of the cycle. This page has not attempted to explain the cycles fully. Instead, it has tried to underscore why they must be understood. To increase understanding of technology cycles, the following article is provided:

How to further understand technology cycles relevance

The recommended next step is the understanding that we have been here before four times previously. The Five technology Cycles

- The US financed WW2 for all of the Allies, in effect taking on the debt of the industrialized world. Since our debt is much higher today, this is very telling as to how out of control our debt has become. ↩︎

- This began in the 1980s under the Reagan administrations. ↩︎

- Industry and Empire. The Birth of the Industrial Revolution. Author Eric Hobsbawm. Published by Penguin Group London, 1968. ↩︎

- From Robert Reich’s book Aftershock. Published by Knopf in 2011. ↩︎