Great technology surge cycles modeling & evolution – Section Four

The technology cycles model that becomes useful – The intellectual courage of Carlota Perez

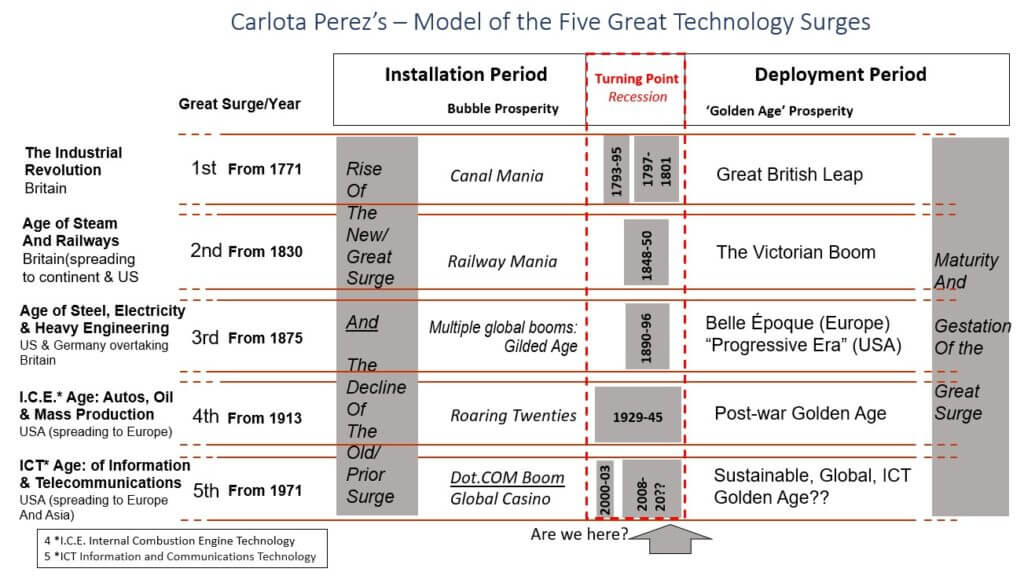

In 2002 Carlota Perez published Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. She described the book as a thought piece but that was likely because innovation surges were outside of traditional mainstream economic canon. They still are but now evolutionary economics is getting closer. Because the Great Technology Surge Cycles have gone Hollywood and are so incredibly misunderstood very shortly after she published her ground breaking book she stopped referring to innovation cycles as long waves instead calling them Techno-Economic Paradigms (Great Surges). We should all simply refer to the technology cycles as Perez Cycles. In the tradition of Joseph Schumpeter who acknowledged Kondratiev’s work – we should now acknowledge Carlota Perez’s brilliant breakthrough thinking and all should refer to innovation surges as Perez Cycles. You will see why in short order.

Technology Cycles are not Seasons

Previously we saw how prior economists had seen clusters of technological innovation which had major impacts on economies worldwide. Two came up with names of seasons or what they felt was occurring with the economy. Perez on the other hand looked at what was going on within the structural segments of the cycles. Her predecessor’s models with their cute names, the models were so generic that the they can and have been applied to almost any point in time or sets of conditions economic and sadly were misapplied in many cases as we saw earlier. Their models are like reading ancient prophesies which are so vague and general, virtually anything, or any time frame can be inserted as the “fulfillment” of the prophecy.

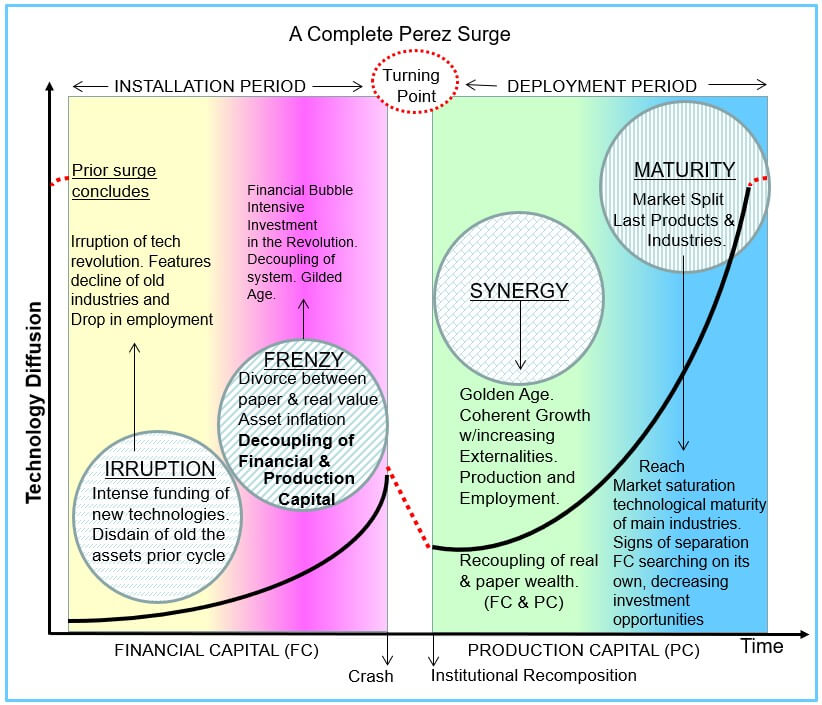

I reference prophecy because models are typically used to predict future events. Let us now look at how she cracked the code and review the changes she delivered. See the chart below on the great technology surge cycles.

Technology Surge Cycles – The Installation Period

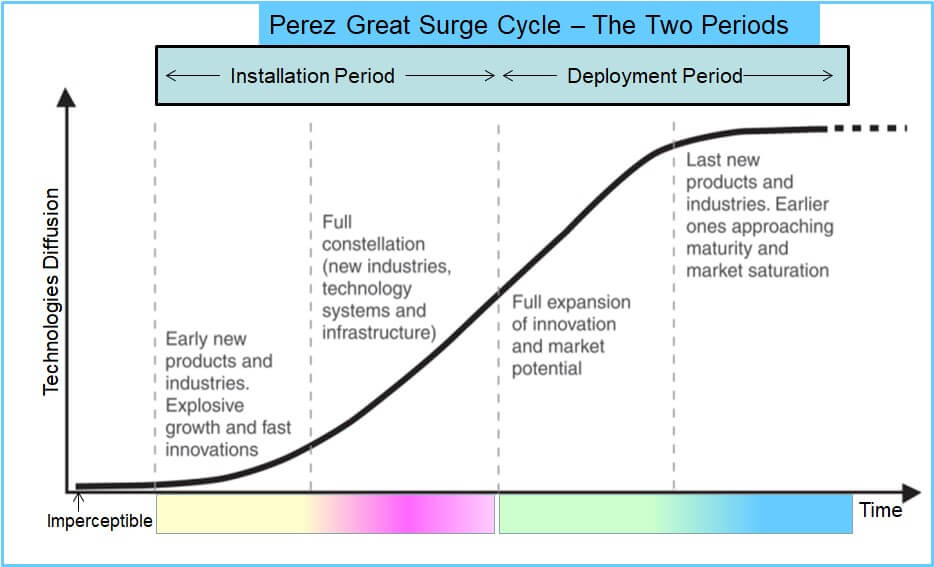

In thinking about what was occurring within the innovation surges she formed a deeper understanding of that activity. Not an over generalized term like prosperity or three words which relate to economic crashes (recession, depression and recovery). In reviewing the history she came to the keen insight that the surges featured two distinct periods. The first was the Installation period. In the Installation period core sets of new technological innovations have taken place albeit virtually imperceptibly at first. However, the core technologies are so valuable that the core grows very rapidly.

Think of the Big Bang and expansion theory as an analogous parallel. New industries are born from the core technologies but the entire economy cannot yet be supported by them. This is a point in time statement only. However related existing technologies are consumed by the new core and many are rendered obsolete. Schumpeter was correct when he called the Kondratiev cycles out as having the trademark in “Creative Destruction.” Perez said the ingredient of creative destruction is in fact the hallmark showing an Installation period is underway. The Installation period is led by financial capital (investors). The investments are concentrated in the new-tech core. These dynamics are very different in the second half of the Perez cycle.

Economic Stagnation

The Installation Period is born into the stagnating economy of the prior Perez Cycle. Because the focus is on the dying technological paradigms of the last remnants of the prior surge the birth in the new core technologies is almost invisible to almost everyone. A good example was the closing of the steel mills and the shuttering of auto plants in 1971 at the end of the prior surge. In that same year Intel invents the microprocessor for Busicom, a business machine company seeking to build an electronic calculator. The reason you never heard of Busicom is they went bankrupt just three short years later in 1974. Intel on the other hand would partner with Microsoft and Compaq and grow into household names worldwide. Quickly investors jumped on the growth of what is called the x86 architecture companies and their market began to grow quickly.

Perez describes the second part of the Installation Period as investors going to the “casino.” The companies the investors are betting on are real enough but many either have absolutely no sales or certainly most are so focused on their brand and market share that they were generating little to no profit. The current Perez Cycle (5) is called the age of Information and Telecommunications (ICT). The Personal Computers (PCs) started to get into homes and businesses. They were very expensive in the early 1990s. With small children I could not afford to buy a new one. Instead, I built mine from components and mounted them on a piece of plywood. I then would dial into online bulletin boards with other PC enthusiasts using external modems that were glacially slow over copper phone lines.

Then came America Online (AOL)

The one I frequented the most, AOL which was a local call for me as they were located in Vienna Virginia, would turn into probably the most famous Internet Service Provider (ISP) of all time. AOL perfectly exemplifies the casino atmosphere. AOL’s valuation became so ridiculously immense that they merged with the media conglomerate Time Warner in January of 2000. I used to send ideas to Steve Case as suggestions to improve his bulletin board service before the merger.

After the merger the new company was renamed AOL Time Warner and Steve Case was named the CEO of the entire media empire! AOL was so overvalued that AOL shareholders were given 55% ownership of the new company! Within five short years AOL, in 2006, would be removed from the name of the company and began their descent into oblivion. The reason why this had occurred requires us to discuss the demarcation point between the Installation and the Deployment periods.

Technology Surge Cycles – The Turning Point

The Turning Point marks the transition out of the Installation period. In the example of the current Perez Cycle, in 2001 the dot.com companies valuations all had become so unreal that their stock values became like overfilled balloons and suddenly popped. This dynamic was referred to as the Dot.Bomb era. Like the rush of air out of a balloon the companies frantically went in search of cash to sustain them. Most either went bankrupt or were purchased for pennies on the dollar. In 1929 during this stage in the 4th Perez Cycle, the Turning Point would become known as the start in The Great Depression.

Despite the fact that the Perez Cycles reoccur, the history within them is new every time. Investment houses still having a casino mentality after seeing their returns crash after 2001 found mortgages as the next potential investment vehicle to sustain the outsized returns they had racked up during the latter stages of the Installation Period. The housing bubble created by the Investment houses in 2008 saw their mortgage-backed securities begin to crash setting off the The Great Recession of 2009. The red dotted circles in the graph above donates all five of the Inflection Points since the start of The Industrial Revolution. To make this point clearly I provide the next chart.

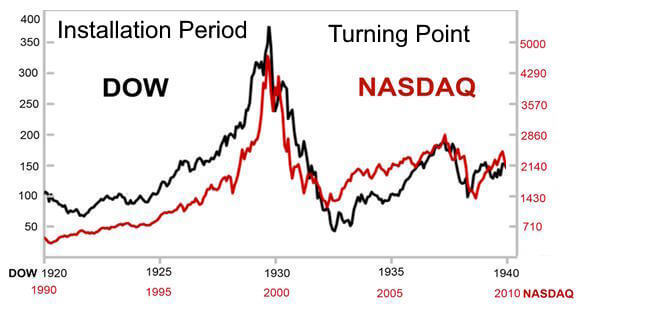

Structural Similarities of the Great Technology Surge Cycles

I offer a brief piece of evidence to the left. It is a comparison of the Dow Jones Industrials (DOW) graphed with the black line vs NASDAQ shown in red. As you can see the Installation Period is depicted through the Turning Points of the Perez Cycles for both Four (in black) and Five (in red). The market behavior was virtually identical. During the fourth surge the big tech companies were listed on the DOW. During the current ICT great technology surge cycle (5) the tech companies were listed on NASDAQ. I had already bought into Carlota’s model years before I found this chart. When I saw the chart on the left 10 years ago, the hairs on the back of my neck stood straight up.

This chart was created more than a decade after Carlota had published her book by someone who was totally unaware of it! The financial company that made the chart still keeps it up to date.1 Now there is more to this model as Perez’s model flexes because history does not repeat like something totally mechanical. History is fluid and the current Great Technology Surge is different than prior ones.

Mental Adaptations

Carlota has simplified her model from her original book, removing the phases due to overlap. This is another remarkable attribute of Carlota. She molds her thinking to only the data and flexes with the data in order to produce as accurate a model as possible. I can tell you just from my strategy work how hard it is to get away from ones original thinking after the fact. It takes strength and Perez clearly has that!

A summary of her updated model follows below; however, for those who want the unedited view, here is a link to an article Carlota wrote outlining her latest thinking. The Carlota Perez Article. Link opens in new browser tab.

Because the differences between the current Turning Point ending vs all the prior ones I am going to list the main points from Carlota’s article below. The impact is incalculable due to the extended damage creating by artificially extending the destruction and turbulence of the Turning Point.

Differences with the current (ICT) Turning Point

Carlota writes: “This time however, things are different. With the current ICT revolution, we seem to be stuck in the installation period or in what I call the ‘turning point’, which is the mid-way time of recessions and uncertainty, revolts and populism that reveals the pain inflicted on society by the initial ‘creative destruction’ process. It is precisely when the system is in danger and is being questioned and attacked that politicians finally understand they must set up a win-win game between business and society. And it is the time when much of business understands it must be done. And yet this time, although installation has been more intense than ever, both in jobs and regional destruction and in lifting new areas and whole countries to development, post bubble crashes have not led to an institutional rethinking to unleash the better and fairer times of the Information revolution.”

Perez’s Delay of ICT Turning Point – Primary Causes:

- Global Finance as main obstacle

- Continued decoupling from production capital

- Casino still in place

- Creates income polarization from top 10% vs majority

- Appreciation of assets results in “differential inflation”

- Asset owners become richer and salary earners poorer

- Socialized Risk, but Private Rewards

- Governments rescue financial world

- Real economy & production investment at all time lows

- Banks used liquidity flood on derivatives

- Governments rescue financial world

- The Consequence of all of this is populism

- Social democratic parties loose power

- Viability of global sustainable golden age is clear in tech & economic terms

- But in political terms probability is very low

- Delayed time only strengthens global finance

- Weakens prospects for reigning it in

- Social democratic parties loose power

- RESULT: A prolonged Gilded Age

Perez’s Secondary Factors:

- China as the mass production factory

- Created new lease on life for the old mass production paradigm

- Old tech became cheaper & not more expensive – inducing wasteful habits

- Vast increase in both markets & labor

- Reintroduction of USSR & China into global economy

- Global Finance

- Lack of government response to the crises strengthened global finance

If you read Carlota’s blog page she outlines a third set of factors as well. Simplistic answers may make some feel good but do not address the complex issues of automation in the information age. All four of the prior Great Surges eventually gave away to Deployment periods and”Golden Ages.” Though we are currently stuck in the ICT’s Turning Point – eventually it will end. Tragically the longer it runs the more damage which will occur. Let us now continue outlining the remainder of Carlota’s model.

The Deployment Period

Then in the second half of the Perez Cycle, she saw that as the core technologies have matured enough to be fully established into every industry. She termed the second half of the surge the Deployment period. Perez calls the Deployment period “Creative Construction.” In contrast to what occurred in the first half of the surge, in the second half the new technological core is transformed in the second half of the surge. Widespread application of the new paradigm for innovation and growth spread throughout the entire economy. The economy is now lead by production capital and no longer investor capital. All industries install the core technologies are remade by the new technology core. The new technologies new paradigm creates the efficiencies which enable steady growth in most industries. The enabling technologies radically remakes management “common sense.”2

The Deployment period transitions out of the stagnation of the Turning Point. In the early stages of the Deployment period the largest companies begin to buy out competitor’s cash strapped companies who became over extended during the frenzy of the casino atmosphere during the Installation period. In the prior Perez Cycle (4) auto makers like General Motors (GM) became the eventual behemoths they would become by buying out all of the car companies that made up GM during the 1940s into 1959. Buick, Chevrolet and Pontiac were competing car companies that GM purchased and integrated into their company. The same was true for Chrysler and Dodge. In the US there were over 100 car makers at the beginning of the 20th century.

Emergence of Technology Standards

By the time the Deployment period was in full force there were maybe four major car makers left. Standards for products also come into being during this period. Turn signals, brakes, odometers and the like all standardized during the Synergy phase. All car makers were forced to standardize as laws were passed which required them to do so. The car companies became increasingly integrated with more function embedded within their products. This is driven by the few large companies which won the battle for brand identity and market share. Those companies invest their steady profits back into their business in order to gain more profit while generating more revenue. Because investment has shifted out of the investment houses the growth rates become slower but much steadier. This is why the Deployment periods are referred to as “Golden Ages” by historians.

Core Technologies begin to lose steam

Technology innovation slows in the Deployment period and about halfway through the technology core which has powered the Great Surge begins to lose its power. The Economy begins to stagnate. Both inflation and unemployment suddenly spike at the same time. Typically, inflation is hallmark of full or over employment. But that is not case with the end of a Perez Cycle. As technology innovation slows commoditization begins to set in. Competitors spring up in other regions competing with lower cost products. Because innovation and differentiation has slowed competition is now value pricing based. In the prior surge this was seen through the Japanese making smaller and cheaper autos and trucks vs the US Big Three automakers (Ford, GM & Chrysler). In Perez Cycle four this dynamic began in 1959.

The Technology Cycle Matures

The 1960s would go on to see decreased economic vitality for the I.C.E (Internal Combustion Engine) technologies. By the end of the decade inflation and unemployment began to rise which ended up becoming stagflation. As a child I still remember watching President Nixon on TV mandating wage and price controls due to the rise in inflation. Techno-economic surges were not understood to any degree at that time in history. The Nixon administration and the Federal Reserve had no idea how to combat this economic dynamic. Truthfully there are no central banking tools to combat this.

The chart which lead this review of Carlota Perez’s model should be regarded as the equivalent of Einstein’s paper proposing the theory of Relativity. Particularly in the field of evolutionary economics. Why? Because she took the information and saw how to visualize to put the puzzle together. The creative destruction in the Installation period versus the creative construction of the Deployment period is not simply elegant. But reflects how techno-economic surges run.

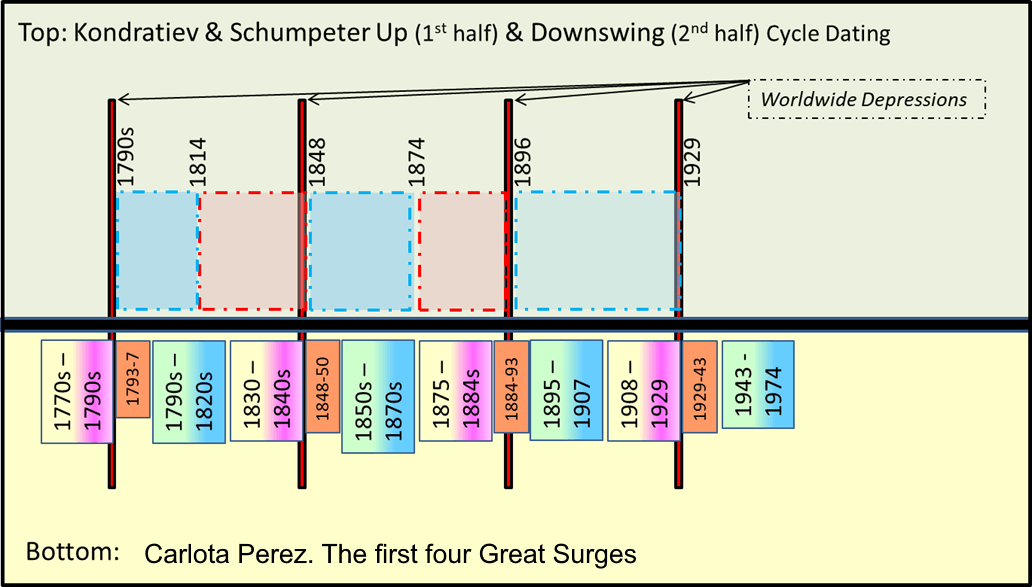

Just as importantly she defined the important factors in how every Great Technology Surge or Perezian Cycle, has had, currently is having, or ever will have. The exact dates were never the thunderclap moment where others had pulled up and said the job is complete. It is the structure which has held up since she started evolving the older general models back in the early 1980s. The next graph illustrates a bit more detail in how her model functions.

The Shape of a Technology Cycle

The source for the slide is from Carlota’s book.3 I did change one element. I used the curve which I had sent to Carlota based on 100 years of market data instead of the gentle S curve from the book. The impact of Perez’s clarity of thinking in her new structure for techno-economic paradigms is readily apparent. The generalist models from the Kondratiev and Schumpeter camps models primarily function by tracking discrete economic events such as recessions represented through sudden higher unemployment. That data can easily become distorted.

Carlota’s model can flex with real history which of course is not set in stone. Covid is a good illustration of this. The pandemic pushed out the timeline for the current cycle. Kondratiev cycle modelers on the other hand will record the sudden surge in unemployment as real phase change due to the sheer amplitude of the event. Meaning they have an incorrect model. And that’s why most do have incorrect models.

Carlota’s model absorbs non techno-economic driven events instead of becoming distorted by them. The structure in how she laid out the Phases showcases just how far-reaching her leap forward was in techno-economic modeling. Carlota Perez worked decades after Kondratiev and Schumpeter. Therefore she of course had a better view as an entire Great Surge had transpired after Schumpeter and Kondratiev were no longer alive. Furthermore, economic data was accrued after the careers of Schumpeter and Kondratiev.

Perez Cycles Continuity

However, even allowing for those two factors, the brilliance of Carlota shines through via the next image. In the image below I have visually depicted what the great Surges were for all three of these incredible economists.

In the chart below I took the Great Surge data from Kondratiev and Schumpeter and compared it with Carlota Perez’s. The very first thing which immediately jumps out is that Kondratiev and Schumpeter were “out of phase” in their 3rd surge. True enough it is more difficult to view the time period one is living through. However, the graph clearly shows that for the 3rd surge they reversed their rising wave with their declining wave. In their models the rising wave should start with the depression and then in the second half of the surge the 2nd wave in the surge should decline. Now why would they both have done this?

Comparing Perez’s model to Kondratiev & Schumpeter

First because they were measuring their surges using discrete factors such as pricing and interest rates instead of aggregate economic data like Perez. They had no idea they were contradicting themselves. Further Carlota cross checks her model with real world events as these Great Technology Surges drive science, politics, economics, and culture.4 IMHO, in short, technology development is the major driver of history.

In their data, they thought they were starting a rising third surge when in reality they were most certainly headed into the world’s deepest depression ever recorded. Did Kondratiev even know about the depression? He was imprisoned in Soviet system that was not permitting world news reporting. So maybe not. Schumpeter on the other hand lived into the 1950s and most certainly did. Perhaps he needed to draw a graph like the one above to make this point to himself. A note to those who cite Kondratiev Waves or Long Waves. They are as accurate as the hokum of the pseudoscience of astrology.

Kondratiev & Schumpeter’s Error

We don’t need to draw anything other than the bare bones date outlines to see that both of their models (Kondratiev and Schumpeter) contain a major error. Just looking at the major worldwide crashes we can see that Kondratiev and Schumpeter models have the crashes in the second half of their models for the first two surges. Then in the third surge this is suddenly reversed. This is why I create visuals to review almost anything. If you look over the rest of this site you will find ample evidence supporting this.

The last factor is Perez updated the model and neither Kondratiev nor Schumpeter were around to see what she has given us. I am confident they would have realized their errors had they lived to see Carlota’s model. The second thing is what the chart demonstrates is Carlota’s cycle surges are logical and balanced. The model she brought into the world reflects aggregate data and maintains its consistency. In other words, the chart amplifies Carlota Perez’s perseverance and brilliance.

Where to now? You can either select from the pull down menu at the top of this page or if you want a recommendation, the next step in technology cycle education should be technology cycles, the depressions and revolutions.

Section three Footnotes Follow:

- Chart from J.C. Phillips. Editor of Forecast-Chart.com’s market trend research. URL https://www.forecast-chart.com/great-depression-stock-chart-nl.html ↩︎

- Carlota Perez Slide from her presentation at APDC’s Summit Lisbon, July 2009 ↩︎

- Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. By Carlota Perez Edward Elgar Publishing. 2002 ↩︎

- Quote from Christopher Freeman. The full quote “market economies evolve in the constant interaction among five semi-autonomous spheres: science, technology, politics, economics, and culture. The good times occur when they enter in synchrony, the turbulent times are those when they are in disharmony.” ↩︎