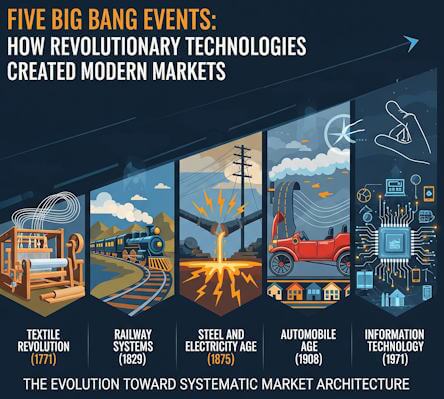

The Evolution of Market Creation Through Big Bangs Technology Cycles

Revolutionary technologies create entirely new economic universes through specific moments we call “Big Bang Events.” These pivotal transformations demonstrate humanity’s growing sophistication in engineering market ecosystems rather than merely discovering them through trial and error.

Consequently, examining five crucial technological revolutions from 1771 to 1971 reveals a fundamental shift from emergent market creation to systematic market architecture. Moreover, this evolution represents one of the most important developments in modern economic history, providing essential insights for understanding contemporary technological challenges and future innovation strategies.

The Arkwright Revolution:

Birth of Industrial Market Creation (1771)

Richard Arkwright’s Cromford Mill opened in 1771, marking the first Big Bang Event of modern capitalism. Furthermore, this moment crystallized decades of mechanical innovation into a replicable system that transformed both production methods and market structures globally.

The water frame spinning technology produced strong, consistent cotton thread suitable for both warp and weft applications. Additionally, Arkwright integrated factory-based organization, water-powered machinery systems, and disciplined labor management into a coherent production system. These innovations enabled dramatic cost reductions—roughly 90% compared to hand spinning—making cotton textiles affordable to previously excluded populations.

Remarkably, this cost revolution created entirely new consumer markets that emerged organically rather than through deliberate planning. Rural agricultural workers and urban craftsmen could suddenly purchase multiple changes of clothing, driving the development of ready-made clothing workshops. The emergence of mass consumer markets for textiles had profound social implications, enabling new forms of personal expression and social mobility through affordable dress.

Market Spillovers Transform Global Trade

Subsequently, textile production created extensive spillover effects across multiple economic sectors. The unprecedented demand for raw cotton drove expansion of American slave-grown cotton cultivation and Liverpool shipping operations. Meanwhile, upstream industries flourished as textile machinery manufacturing expanded to serve growing mill construction.

Downstream markets also experienced dramatic growth. Dye works, bleach fields, and printed calico industries expanded to serve processed cotton textile demand. These interconnected market developments demonstrated how Big Bang Events create cascading transformations across entire economic ecosystems.

Foundational Standards Enable Scalability

Crucially, Arkwright’s system established foundational patterns for industrial standardization. Technical design standards included consistent spindle sizes and pulley dimensions for water frames. Process standards encompassed mill architecture optimized for power shaft distribution and systematic workforce management.

Product standards enabled uniform thread counts and standard cloth widths. Additionally, replication mechanisms through licensing agreements allowed technology transfer across Lancashire and Derbyshire. These codification elements proved essential for scaling factory-based production beyond individual locations.

The Railway Revolution:

Systematic Transportation Networks (1829)

George Stephenson’s “Rocket” locomotive triumphed at the 1829 Rainhill Trials, demonstrating commercial viability for steam-powered railway transportation. The subsequent Liverpool-Manchester Railway opening in 1830 represented a qualitative advance in systematic market creation approaches.

Unlike textile development, railway pioneers explicitly recognized their innovations’ market creation potential. They developed coordinated infrastructure investment, pricing strategies, and service design to create entirely new categories of economic activity systematically.

Mass Transportation Creates New Economic Geographies

Railway systems created mass passenger travel markets by reducing both costs and travel times by approximately an order of magnitude. Consequently, intercity travel became accessible to broader populations, enabling commuting over greater distances and separating residential areas from employment locations.

Tourism markets emerged as seaside resorts like Blackpool became accessible to working-class families through affordable railway travel. Time-sensitive freight markets developed for dairy products, fish, and newspapers that could maintain commercial value during rapid transport. These markets had not previously existed at significant scale under earlier transportation systems.

Infrastructure Integration Requires Sophisticated Coordination

Building railway networks demanded unprecedented coordination across multiple jurisdictions, extensive capital mobilization, and complex regulatory frameworks. Joint-stock company structures enabled large-scale investment, while systematic approaches to civil engineering established methodologies for railway construction projects globally.

Safety systems evolved through block signaling that prevented multiple trains from occupying the same track section simultaneously. Furthermore, temporal coordination required standardized time systems, initially based on local solar time but eventually evolving toward Greenwich Mean Time adoption for scheduling consistency.

International Standards Enable Global Expansion

Railway development established comprehensive technical standards enabling global technology transfer. The 4 foot 8½ inch gauge became a de facto standard, though standardization occurred gradually. Locomotive designs, rolling stock specifications, and infrastructure components achieved consistency enabling economies of scale in manufacturing.

International railway development exported British engineering expertise and equipment through systematic technology transfer programs. Professional networks for railway engineers created knowledge sharing mechanisms across national boundaries, facilitating rapid international expansion of railway technology while maintaining technical standards and operational effectiveness.

The Steel and Electrical Revolution:

Engineered Market Architecture (1875)

Andrew Carnegie’s Bessemer steel plant opening in Pittsburgh in 1875 marked the first systematic application of engineered market creation principles. Unlike earlier cycles, Carnegie’s approach demonstrated deliberate market cultivation and coordinated technological deployment designed specifically to create new economic categories.

Steel production enabled entirely new construction possibilities through materials with superior strength and consistency compared to earlier alternatives. Skyscraper development became economically viable, creating vertical real estate markets in urban areas. Steel shipbuilding enabled larger, more efficient vessels for international trade and passenger travel.

Electrical Systems Create New Infrastructure Categories

Simultaneously, electrical power development required steel structural support for transmission lines and power generation facilities. Steel-framed buildings could accommodate electrical wiring and equipment necessary for electric lighting and power applications.

Thomas Edison’s Pearl Street Station and George Westinghouse’s alternating current systems competed to establish electrical power standards. These electrical networks enabled new industrial processes, extended productive hours through artificial lighting, and created entirely new categories of consumer appliances and services.

Vertical Integration Demonstrates Supply Chain Mastery

Carnegie’s vertical integration strategy controlled everything from raw material production to finished steel distribution. The River Rouge complex eventually encompassed steel production, transportation systems, and final product manufacturing within integrated facilities.

This comprehensive approach demonstrated sophisticated understanding of supply chain coordination that exceeded earlier industrial development. Moreover, systematic quality control procedures ensured consistent steel grades with defined chemical compositions and mechanical properties for specific applications.

Global Standards Enable International Markets

Professional organizations like the American Society for Testing and Materials (ASTM) established systematic procedures for materials testing and specification. These standards enabled international trade in steel products while ensuring quality and performance consistency.

The Institute of Electrical and Electronics Engineers (IEEE) developed electrical engineering standards for voltage, frequency, and equipment compatibility. These standards proved crucial for creating integrated electrical networks and enabling equipment interoperability across different manufacturers and geographic regions.

The Automobile Revolution:

Mass Production and Consumer Culture (1908)

Ford’s Model T introduction in 1908, followed by assembly line implementation in 1913, represented the full maturation of engineered market creation. Every aspect of technological development—product design, manufacturing processes, and market cultivation—received systematic planning and coordination.

The Model T prioritized manufacturability, reliability, and affordability over traditional luxury characteristics. Ford’s team systematically analyzed mass production requirements and designed both products and processes to achieve unprecedented efficiency and cost reduction levels.

Assembly Line Innovation Transforms Manufacturing

The Highland Park plant’s moving assembly line represented systematic application of industrial engineering principles. Every production process aspect received analysis, timing, and optimization to achieve maximum efficiency while maintaining quality standards.

Workers performed specific tasks that required minimal training but enabled higher overall productivity levels. This approach democratized manufacturing employment while achieving dramatic cost reductions—the Model T’s price dropped from $825 in 1908 to $290 in 1925.

Consumer Finance Creates Mass Markets

Automobile ownership required substantial purchase investments that exceeded most families’ immediate purchasing power. Consequently, installment payment plans and secured lending arrangements created consumer credit mechanisms that enabled mass market access to expensive consumer goods.

General Motors Acceptance Corporation pioneered systematic automobile financing that would later apply to other consumer durables. These financial innovations proved crucial for enabling mass consumption patterns that could support mass production economics.

Infrastructure Development Supports Adoption

Automobile adoption demanded improved roads and highway systems requiring massive public investments in transportation infrastructure. Federal Highway Act and standardized road construction specifications created systematic approaches to highway engineering and construction.

Traffic control systems evolved through standardized signals, signs, and road markings that enabled safe vehicle operation across expanding road networks. These infrastructure investments created new patterns of economic development favoring areas with highway access while supporting further automotive adoption.

Global Manufacturing Networks Emerge

Ford’s international expansion required systematic technology transfer that adapted mass production techniques to different national contexts. Comprehensive technology transfer procedures established capabilities for international manufacturing expansion while maintaining product quality and operational efficiency.

The Society of Automotive Engineers (SAE) established technical standards enabling component interoperability across different manufacturers. These standards facilitated automotive supply industry development while ensuring technical compatibility and enabling global manufacturing coordination.

The Information Revolution:

Platform Ecosystems and Network Effects (1971)

Intel’s 4004 microprocessor development in 1971 represented the ultimate expression of engineered market creation. The information revolution explicitly designed global technological ecosystems characterized by network effects, platform architectures, and systematic market engineering from inception.

Microprocessor development integrated advanced semiconductor manufacturing, systematic software development, and platform architecture design into strategies designed to create and control entire technological and economic activity categories. And that is part of the issue with the current technology cycle.

From Digital Monopolies to Deployment Blockage:

How Fifth Cycle Platform Concentration Is Preventing the Transition to Synergy

The Current Technology Cycle’s Extended Turning Point Crisis

We stand at an unprecedented moment in technological history. While previous Big Bang Events—from Arkwright’s textile revolution in 1771 to Intel’s microprocessor breakthrough in 1971—successfully navigated through their complete technology cycles, from Installation through Turning Point to Deployment, our current Fifth Technology Cycle remains trapped in an extended Turning Point crisis that has persisted for over two decades.

According to Carlota Perez’s technology cycle framework, we should have transitioned from the Fifth Cycle’s Turning Point (beginning around 2000 with the dot-com crash) into a Deployment Period characterized by Synergy—where regulation reconnects finance with production, enabling broad diffusion of technology and economic golden age growth. Instead, the Fifth Cycle never completed its normal progression because digital platform technologies created winner-takes-all monopolies that prevent the competitive market formation essential for successful Deployment.

This stagnation reveals a fundamental structural problem that distinguishes our current moment from historical precedents: unlike previous cycles where Turning Point crises led to regulatory reforms that enabled competitive Deployment periods, the Fifth Cycle’s digital monopolies have captured regulatory processes and financial systems, preventing the market correction mechanisms that historically enabled technology cycles to progress from crisis to golden age prosperity.

Understanding this monopolization dynamic becomes crucial for unlocking the Fifth Cycle’s stalled Deployment period.

The Technology Cycle Framework:

How Previous Cycles Successfully Navigated Turning Points

Perez’s framework demonstrates that technology cycles follow predictable patterns through four major periods: Gestation (core formation), Installation (Irruption and Frenzy), Turning Point (crisis and reform), and Deployment (Synergy and Maturity). The critical transition occurs at the Turning Point, where financial bubble collapse creates opportunities for regulatory reform that reconnects finance with production capital, enabling the Deployment period’s competitive market development.

Historical Success Pattern: Crisis Enables Reform

Previous technology cycles successfully navigated their Turning Point crises through regulatory reforms that restored competitive market mechanisms:

– First Cycle (1793-1797): The textile revolution’s Turning Point crisis led to financial reforms that enabled competitive textile, chemical, and metallurgy markets during the 1797-1829 Deployment period.

– Second Cycle (1848-1850): The railway speculation crash prompted regulatory frameworks that fostered competitive railway, steam, and machine tool industries during the 1850-1873 Deployment.

– Third Cycle (1893-1895): The steel and electrical crisis generated antitrust legislation and utility regulation that enabled competitive electrical, steel, and telecommunications markets during the 1895-1918 Deployment.

– Fourth Cycle (1929-1943): The Great Depression triggered comprehensive financial and regulatory reforms—including antitrust enforcement, securities regulation, and public infrastructure investment—that enabled the competitive automotive, oil, and petrochemical markets of the 1943-1974 Deployment period.

Each successful Turning Point featured the same pattern: financial bubble collapse, political upheaval, regulatory reform, and transition to competitive Deployment characterized by broad-based prosperity and technological diffusion.

The Fifth Cycle’s Broken Pattern: Crisis Without Reform

The Fifth Cycle broke this historical pattern. The dot-com crash of 2000-2002 created the expected Turning Point crisis, followed by additional financial disruptions in 2008 (Great Recession) and 2020 (pandemic-induced recession). However, these crises failed to generate the regulatory reforms necessary for Deployment transition.

Instead of breaking up concentrated market power and restoring competitive mechanisms, policy responses focused on financial system stabilization while allowing digital platform monopolies to consolidate further. The result is an extended Turning Point that has persisted for over two decades, preventing the emergence of Fifth Cycle Deployment period.

The Fifth Cycle’s Structural Failure: Digital Monopolies Replace Competitive Markets

Unlike all previous Big Bang Events, which created competitive ecosystems during their Installation periods that could be reformed and regulated during Turning Point crises, the Fifth Cycle’s Installation period (1971-2000) produced integrated monopolies that resist the competitive market formation essential for Deployment.

Previous Cycles Built Competitive Foundations During Installation

Each previous cycle’s Installation period established competitive market structures that could be enhanced through Turning Point reforms:

– First Cycle: The textile Installation period created competitive cotton production, machinery manufacturing, mill operations, and trading networks that regulatory reform could optimize during Deployment.

– Second Cycle: Railway Installation established competing railway companies, locomotive manufacturers, and steel producers that standardization and regulation could coordinate during Deployment.

– Fourth Cycle: Automotive Installation generated hundreds of competing manufacturers, suppliers, and service providers that New Deal reforms could regulate into stable competitive markets during Deployment.

Each Installation period featured initial disruption and speculation (Irruption and Frenzy) followed by Turning Point crisis that enabled regulatory reform to create stable competitive markets during Deployment.

Digital Platforms Create Monopolistic Installation

The Fifth Cycle’s Installation period (1971-2000) followed a fundamentally different pattern. Instead of creating competitive markets that could be regulated during the Turning Point, digital platforms created winner-takes-all monopolies during Installation itself:

Digital products have high fixed costs and low-to-zero marginal costs, combined with network effects where platform value increases disproportionately as user bases expand. This creates market tipping where “once a tech company achieves clear market leadership, it soon attains complete dominance and is almost impossible to displace.”

The result is unprecedented industrial concentration that emerged during Installation rather than requiring Deployment period formation:

– Google controls 90% of global search

– Meta dominates social networking

– Amazon controls vast portions of e-commerce and cloud computing

– Microsoft maintains desktop computing dominance while expanding into cloud services

– Apple controls mobile app distribution through iOS

Monopolization Prevents Turning Point Market Correction

These monopolistic structures resist the market correction mechanisms that enabled previous cycles’ Turning Point transitions. Traditional regulatory approaches—antitrust enforcement, utility regulation, financial reform—prove inadequate for digital platforms that operate across multiple industries simultaneously while leveraging network effects to maintain dominance.

The monopolistic installation creates three systematic barriers preventing Deployment transition: resource capture, regulatory dysfunction, and financial distortion.

Resource Capture: Digital Monopolies Control Capital Allocation

Digital platform monopolies capture the resource allocation mechanisms that previous cycles used to build competitive markets during their Deployment periods, preventing the Fifth Cycle Deployment period.

Platform Monopolies Concentrate Investment Flows

During previous cycles’ Deployment periods, competitive markets distributed investment across numerous companies and sectors. The Fourth Cycle’s automotive Deployment saw hundreds of manufacturers investing in production capacity while competitive supplier industries emerged for steel, rubber, glass, and components. Investment flowed to roads, gas stations, and repair services through market mechanisms.

The Fifth Cycle’s monopolistic structure concentrates capital allocation within platform companies rather than distributing it across competitive markets. Amazon’s $50+ billion annual capital expenditures focus primarily on logistics infrastructure and cloud computing expansion to maintain monopoly positions. Google’s massive investments serve primarily to strengthen search and advertising dominance rather than enable broader technological diffusion.

This concentration prevents the distributed investment that characterized previous cycles’ Deployment periods, where competitive markets allocated capital efficiently across entire industry ecosystems.

Talent Concentration Limits Innovation Distribution

Digital platform monopolies concentrate technical talent in ways that prevent the distributed innovation characteristic of previous cycles’ Deployment periods. Google employs over 150,000 technical workers focused primarily on maintaining search and advertising monopolies. Amazon’s technical workforce focuses heavily on logistics and cloud computing optimization to preserve market dominance.

During the Fourth Cycle’s automotive Deployment, technical talent distributed across hundreds of manufacturers, supplier companies, and related industries, enabling rapid innovation and improvement across entire ecosystems. Contemporary talent concentration serves monopoly maintenance rather than broad technological advancement.

Regulatory Dysfunction:

Monopoly Complexity Overwhelms Democratic Governance

The complexity and invisibility of digital platform monopolies create regulatory challenges that prevent the democratic oversight and market correction that enabled previous cycles’ successful Turning Point transitions.

Digital Invisibility Prevents Democratic Participation

Previous technology cycles operated through visible, physical systems that citizens could understand and regulate through democratic processes. Railway safety, steel quality standards, and automobile regulations could be debated meaningfully by populations who understood the basic technologies and their social implications.

Digital platform operations remain largely invisible and incomprehensible to general populations. Citizens cannot meaningfully evaluate platform algorithms, data collection practices, network effects, or market concentration dynamics. Traditional democratic mechanisms—public hearings, legislative debate, electoral accountability—become inadequate when dealing with monopolistic structures whose operations cannot be observed or communicated effectively.

This participation crisis enables platform monopolies to operate with limited democratic accountability while making decisions that affect billions of people through proprietary algorithms and business models that remain opaque to public scrutiny.

Regulatory Capture Through Technical Complexity

Platform companies deploy teams of economists, lawyers, and technical experts to regulatory proceedings, overwhelming government agencies with limited technical capacity. They leverage complexity to argue that traditional antitrust approaches don’t apply to digital markets, that network effects create consumer benefits, and that monopolistic concentration results from superior innovation rather than anticompetitive practices.

This regulatory capture prevents the market correction mechanisms that enabled previous cycles to navigate their Turning Points successfully. Traditional regulatory tools designed for visible, physical industries prove inadequate for digital platforms that operate across multiple markets simultaneously while leveraging proprietary algorithms.

Fragmented Authority Enables Monopoly Expansion

Digital platform monopolies operate across traditional regulatory boundaries in ways that prevent coherent oversight. Google’s activities span search, advertising, cloud computing, mobile operating systems, and hardware manufacturing—each potentially subject to different regulatory authorities with incompatible approaches.

Previous cycles operated within coherent regulatory frameworks that could address technological implications systematically. Railway regulation addressed safety, pricing, and market access through unified approaches. Automotive regulation handled safety, environmental impacts, and competition through integrated oversight.

Digital platform fragmentation enables regulatory arbitrage, where companies shift activities between jurisdictions and frameworks to avoid effective oversight, preventing the comprehensive reform that enabled previous Turning Point transitions.

Financial System Distortion:

Monopoly Returns Prevent Competitive Capital Formation

Digital platform monopolies generate financial returns and investment patterns that prevent the competitive capital formation essential for the Fifth Cycle Deployment period.

Monopoly Rents Replace Competitive Returns

During previous cycles’ Deployment periods, competitive markets generated returns that attracted diverse capital sources while maintaining market discipline. Textile mills, railway companies, and automotive manufacturers faced competitive pressures that limited excessive returns while encouraging productive investment in capacity expansion and technological improvement.

Digital platform monopolies generate extraordinary returns through market power rather than competitive excellence. Network effects and winner-takes-all dynamics enable companies to increase pricing power as market share grows, removing the competitive pressures that drive beneficial capital allocation in functioning markets.

These monopoly rents attract investment toward platform expansion and monopoly maintenance rather than competitive market development or new technology cycle investment.

Winner-Takes-All Investment Patterns Prevent Distributed Development

Financial markets have adapted to optimize for winner-takes-all outcomes rather than competitive market development. Venture capital firms seek to identify and fund potential monopolists rather than build competitive industries. This creates high-risk investment patterns focused on monopoly capture rather than the sustainable business development that characterized previous cycles’ Deployment periods.

Previous cycles’ Deployment periods featured distributed capital formation where hundreds of companies received incremental investment for competitive development. Contemporary investment concentrates on a few potential monopolists while systematically undercapitalizing competitive alternatives.

Valuation Metrics Favor Concentration Over Competition

Financial markets have developed valuation metrics that reward network effects, user acquisition, and market concentration rather than the productive efficiency, customer satisfaction, and competitive excellence that drove previous cycles’ successful Deployment periods.

These valuation approaches encourage business models that prioritize market capture over value creation, leading to systematic capital misallocation away from productive competitive development toward monopolistic platform expansion that prevents the Fifth Cycles maturation.

The Deployment Blockage:

How Monopolies Prevent Technology Cycle Progression

The combination of resource capture, regulatory dysfunction, and financial distortion created by Fifth Cycle monopolies prevents the normal technology cycle progression that should enable both current cycle Deployment and next cycle Installation.

Blocked Fifth Cycle Deployment

The Fifth Cycle cannot enter its Synergy phase because digital monopolies prevent the competitive market formation that characterizes successful Deployment periods. Instead of “regulation reconnecting finance with production” and “broad diffusion of technology,” monopolistic platforms extract rents while limiting technological diffusion to maintain market control.

Telecommunications, software, networking, and digital media—the Fifth Cycle’s core industries—remain concentrated in monopolistic platforms rather than developing into competitive market ecosystems that could generate “economic golden age” prosperity characteristic of previous Deployment periods.

The Path Forward: Breaking Digital Monopolies to Enable Technology Cycle Progression

Enabling the Fifth Cycle Deployment requires addressing the monopolistic structures that prevent normal technology cycle progression through comprehensive market structure reform.

Antitrust Enforcement for Competitive Market Restoration

Successful Turning Point transitions historically required breaking concentrated market power and restoring competitive mechanisms. The Fourth Cycle’s successful Deployment period emerged from comprehensive New Deal reforms that included aggressive antitrust enforcement, securities regulation, and public infrastructure investment.

Contemporary antitrust enforcement must address digital platform monopolies through structural separation that restores competitive market foundations. Breaking up integrated platform monopolies would enable competitive development in digital infrastructure, applications, and services:

– Separating Amazon Web Services from e-commerce operations would create competitive cloud computing markets

– Dividing Google’s search operations from advertising platforms would enable competitive advertising markets

– Splitting social media platforms from content delivery systems would restore competitive media markets

Structural separation would restore the competitive market foundations necessary for the Fifth Cycle Deployment period.

Public Digital Infrastructure Development

Previous cycles’ successful Deployment periods relied on public infrastructure that provided common-carrier foundations for competitive market development. Roads, electrical grids, and telecommunications systems operated as shared resources that enabled competitive business development rather than monopolistic platform control.

Contemporary public digital infrastructure could provide similar competitive foundations:

– Public cloud computing services would enable competitive application development

– Open-source platform alternatives would prevent monopolistic gatekeeping

– Public data repositories would enable competitive innovation without platform dependencies

Public infrastructure development would restore the shared resource foundations that enabled previous technology cycles’ competitive market formation.

Financial System Reform for Competitive Capital Formation

Successful Deployment periods historically featured financial systems that rewarded competitive excellence and productive investment rather than monopolistic concentration. Contemporary financial reform must redirect capital allocation toward competitive market development:

– Investment incentives for competitive market participation rather than monopoly capture

– Valuation metrics that reward productive efficiency and customer value creation

– Patent reform that enables collaborative development and competitive innovation

Financial system reform would restore the competitive capital formation mechanisms essential for technology cycle progression.

Conclusion: Technology Cycle Restoration for Economic and Democratic Renewal

The extended Turning Point in our Fifth Technology Cycle reflects a fundamental break from historical patterns where financial crises enabled regulatory reform and competitive market restoration. Digital platform monopolies have captured the resource allocation, regulatory oversight, and financial systems that historically enabled technology cycles to progress from crisis to golden age prosperity.

Successfully enabling both Fifth Cycle Deployment requires recognizing that monopolistic market structures fundamentally prevent the competitive dynamics essential for technology cycle progression. The resource constraints, regulatory capture, and financial distortions created by digital platform monopolies require structural correction through the comprehensive reform that characterized previous successful Turning Point transitions.

The stakes extend beyond economic transformation to the fundamental question of whether market economies can maintain the competitive dynamics necessary for technological progress and democratic governance. Previous Turning Point crises demonstrated societies’ capacity for structural reform that enabled decades of shared prosperity and technological advancement.

The path forward requires sustained commitment to competitive market restoration through antitrust enforcement, public infrastructure development, and financial system reform that matches the scope and ambition of previous successful Turning Point transitions. This structural approach would restore the competitive foundations for Fifth Cycle Deployment.

Success would unlock not only the transformative potential of current and emerging technologies but also demonstrate democratic societies’ continued capacity for institutional reform and economic renewal in response to monopolistic market failure. Failure would perpetuate technological stagnation and economic concentration that undermine both innovation and democratic governance.

The choice between competitive market restoration and continued monopolistic stagnation remains open, but the historical pattern suggests that extended Turning Points eventually require the structural reforms necessary for technology cycle progression. The urgency lies in implementing these reforms deliberately rather than waiting for crisis-driven transformation that may prove more disruptive and less democratically controllable.

Next Chapter Six: Innovation Clustering

Below is the New Markets Creation listing for the innovations and bibliographies for Disruptions Dawn within the technology cycle library.

Innovation and Bibliography listing New Market Creations

The main entrance to Technology Cycles Main Library – The Singularity Stacks Link

Link to return to Disruptions Dawn menu