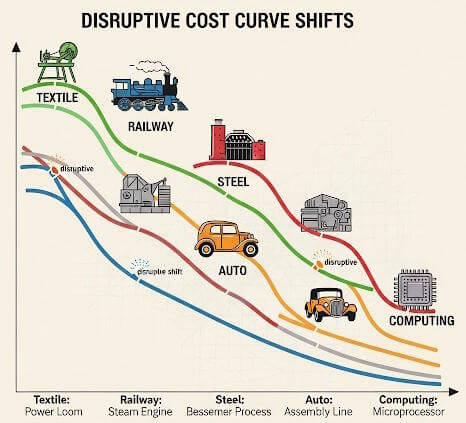

Disruptive Cost Curve Shifts: A Summary of Technological Transformation

The concept of disruptive cost curve shifts represents one of the most powerful mechanisms of economic and social transformation in modern history. These dramatic reductions in the cost of production, operation, or adoption of core technologies serve as the primary catalyst that transforms niche innovations into mass-market revolutions. When examining Carlota Perez’s framework of five major technology cycles, each “Big Bang” moment can be characterized by a fundamental cost curve disruption that enabled previously impossible scales of adoption and created cascading effects throughout entire economic systems.

The disruptive cost curve shifts are not merely incremental improvements but represent threshold crossings where technological capability aligns with economic viability to unlock exponential growth. From Richard Arkwright’s mechanization of textile production in 1771 to Intel’s microprocessor revolution in 1971, these transformations share common patterns while demonstrating increasing sophistication in their mechanisms and scope of impact.

Cycle 1: The Industrial Revolution (1768-1829) – Mechanization as Liberation

The first major cost curve disruption of the modern era emerged from the fundamental limitations of the cottage industry system that had dominated textile production for centuries. Before Arkwright’s water frame, textile production operated under severe constraints that limited both productivity and market access. Individual households spinning wool by hand could produce approximately one pound of yarn per day, with significant quality variations and coordination challenges that kept costs prohibitively high for most consumers.

Arkwright’s water frame created a dramatic break from this paradigm by mechanizing the spinning process and concentrating production in dedicated facilities. The cost reduction was extraordinary—mechanized spinning reduced labor costs per unit by 80-90% while simultaneously improving consistency and enabling higher volumes. This wasn’t simply a more efficient way of doing the same thing; it represented a completely different approach to organizing production that would become the template for industrial capitalism.

The scaling dynamics revealed the full transformative potential of this cost curve shift. As mechanized production expanded, it created positive feedback loops through supply chain specialization, infrastructure development, and skill enhancement that further amplified the cost advantages. The geographic concentration of mills near water sources created industrial clusters that achieved additional efficiencies through proximity and shared resources.

Most significantly, the dramatic cost reductions didn’t just serve existing markets more efficiently—they created entirely new categories of demand. As textile prices fell, manufactured clothing became accessible to social classes that had previously relied on homemade or second-hand garments. This market expansion demonstrated how cost curve shifts can reveal latent demand that was previously suppressed by high prices, creating positive feedback loops that justify continued investment and further cost reduction.

Cycle 2: Steam & Railway Age (1829-1873) – Speed as Economic Revolution

The railway revolution demonstrated how cost curve disruption could transform not just individual industries but entire economic geographies. Before George Stephenson’s Rocket proved the viability of steam locomotion in 1829, land transportation relied on horse-drawn vehicles and canal systems that imposed severe limitations on speed, volume, and geographic reach of goods movement.

The locomotive breakthrough created cost advantages that were even more dramatic than textile mechanization. Railway transport reduced per-ton-mile costs by 80-90% compared to horse-drawn alternatives while offering superior speed and reliability. More importantly, the network effects of railway systems created value that increased exponentially with each additional mile of track, as new origin-destination pairs multiplied the utility of the entire system.

The economic implications extended far beyond transportation cost reduction. The speed and reliability of railway transport enabled new forms of inventory management, production scheduling, and geographic specialization that fundamentally altered industrial organization. Manufacturers could source raw materials from wider areas while serving distant markets, enabling optimization based on natural advantages rather than proximity constraints.

The infrastructure requirements of railway development necessitated financial innovations that would transform capital markets. Railway companies became the first large-scale corporations with widely distributed ownership, driving the development of stock exchanges and new governance structures. The success of railway investments demonstrated the potential returns from infrastructure development while creating institutional capabilities that would prove essential for subsequent technology cycles.

Regional economic integration accelerated as transportation costs fell and local price variations began to converge. This created larger, more liquid markets that enabled greater specialization and more efficient resource allocation, establishing patterns of economic organization that would characterize modern industrial society.

Cycle 3: Steel & Electrical Age (1875-1918) – Materials Revolution

The steel revolution represented perhaps the most dramatic single cost curve shift in industrial history. Andrew Carnegie’s implementation of the Bessemer process achieved cost reductions that were almost unimaginable under previous production methods—steel prices fell from approximately $170 per ton to under $20 per ton within two decades, representing a reduction of more than 85 percent.

This cost collapse made steel economically viable for applications that had been impossible under iron-based economics. The construction of skyscrapers, long-span bridges, modern railway systems, and naval vessels all became feasible when steel prices fell to levels that made these applications commercially viable. Urban development experienced fundamental transformation as steel-frame construction enabled buildings of unprecedented height while making efficient use of expensive urban land.

Carnegie’s approach demonstrated how organizational innovation could amplify the cost advantages created by technological advancement. His strategy of vertical integration—controlling iron mines, transportation systems, and finishing operations—created additional cost advantages that compounded the benefits of the Bessemer process. The scale of operations enabled continuous investment in improvement while achieving economies that competitors found difficult to match.

The parallel development of electrical systems created synergistic effects when combined with steel infrastructure. Electrical power generation, transmission, and distribution all required substantial steel infrastructure while enabling new forms of industrial organization. The integration of steel construction with electrical power created possibilities for industrial automation and urban electrification that would become central to modern economic organization.

The international implications of steel production technology created new patterns of economic competition and development. Countries without adequate steel production capabilities faced significant disadvantages in infrastructure development and military capacity, driving technology transfer and creating global competitive dynamics that would influence international relations throughout the industrial age.

Cycle 4: Automobile Age (1908-1974) – Mass Production Revolution

Henry Ford’s implementation of the moving assembly line created one of the most dramatic cost curve shifts in industrial history, fundamentally transforming not only automobile production but establishing principles of mass production that would reshape manufacturing throughout the 20th century. The assembly line reduced automobile production time from over 12 hours per vehicle to approximately 90 minutes, creating cost reductions that enabled the transformation of automobiles from luxury goods to mass consumer products.

The Model T’s price fell from $850 in 1908 to under $300 by the 1920s, bringing automobile ownership within reach of middle-class families for the first time. This price reduction created enormous expansion in automobile demand, with Ford’s production volumes increasing from thousands of vehicles annually to over a million vehicles per year, demonstrating the market creation effects of dramatic cost reduction.

Supply Chain Integration

The supply chain integration required for mass production created new industrial ecosystems and business models. Steel, glass, rubber, and textile industries all had to adapt their production methods to meet the volume and specification requirements of automobile mass production, often requiring substantial investments in new equipment and processes. The geographic concentration of automotive production created industrial clusters that achieved additional cost advantages through proximity and specialization.

The consumer market transformation extended far beyond transportation to influence residential patterns, employment mobility, and social organization. The mobility provided by automobile ownership enabled suburban development patterns while creating new categories of businesses and services. The development of consumer credit systems to finance automobile purchases created new financial institutions and lending practices that would become standard for consumer durable goods.

The success of mass production demonstrated how wage innovation could create virtuous cycles of growth. Ford’s $5 daily wage recognized that mass production required mass consumption, creating higher wages that enabled higher consumption, which enabled higher production volumes, which justified still higher wages. This approach to wage-setting became a template for labor relations throughout the mass production economy.

Cycle 5: Information Age (1971-Present) – Digital Convergence

Intel’s introduction of the 4004 microprocessor in 1971 initiated a cost curve shift that would prove more sustained and transformative than any previous technology cycle. Unlike earlier cycles that achieved dramatic one-time cost reductions, microprocessor technology demonstrated continuous exponential improvement following Moore’s Law, creating ongoing cost reductions and capability enhancements over decades.

The standardization implications of microprocessor architecture created platform effects that enabled software development industries to achieve massive scale economies. Unlike custom hardware architectures that had characterized early computing, microprocessors provided standardized instruction sets that enabled software portability and reusability across multiple hardware implementations, fundamentally changing the economics of software development.

The emergence of personal computing democratized access to computing capability while creating entirely new categories of applications and markets. The cost reductions enabled by continued technological improvement brought computing within reach of individual users rather than requiring shared access to institutional systems, creating new software markets focused on individual productivity, entertainment, and communication.

Internet Transformation

The Internet transformation created the most dramatic cost curve shift in information distribution and communication in human history, reducing information transmission costs to near zero while enabling global reach and instant delivery. The Internet’s packet-switched architecture and standardized protocols created a distributed system that could scale to global proportions while enabling entirely new categories of economic activity based on information rather than physical goods.

Mobile computing eliminated the location constraints that had limited computing access since the technology’s inception. The smartphone revolution demonstrated how convergence of multiple technologies could create entirely new categories of applications and services while achieving global adoption at scales that dwarfed all previous computing markets.

The software industry pioneered new economic models based on infinite scalability with near-zero marginal costs, fundamentally different from the economics of physical goods production. Software products could be replicated and distributed at minimal cost once developed, creating possibilities for achieving massive scale economies while serving global markets through digital distribution.

This is because of the collapse of traditional competitive barriers

all the previous technological shifts (e.g. the steam engine, electricity, autos etc) improved productivity but still required physical infrastructure, supply chains, and incremental capital investment. Digital technologies obliterate these barriers by allowing anyone, anywhere, to access cutting-edge resources, intelligence, and customers. Competitive advantage shifts from cost leadership to continuous strategic innovation and differentiation. This was a first for humanity. See essay at the end for explanation of this counterintuitive result.

Comparative Analysis and Evolution

The five technology cycles’ dynamics reveal consistent patterns and evolutionary changes in how disruptive cost curve shifts manifest and propagate through economic systems. Early cycles relied primarily on mechanical substitution for human and animal labor, achieving dramatic cost reductions through increased speed, consistency, and scale of physical processes. Later cycles introduced more complex combinations of technological and organizational innovation, while the information cycle represents a qualitatively different category based on digitization and network effects.

The infrastructure requirements for realizing cost curve benefits have evolved from primarily physical infrastructure in early cycles to increasingly complex system-level infrastructure that creates value through interconnection and standardization. Network effects have become progressively more important, with the information cycle demonstrating how infrastructure can create value that increases exponentially with the number of connected users and applications.

Market creation effects have become more sophisticated across cycles, evolving from serving existing markets more efficiently to creating entirely new categories of goods and services. The information cycle has enabled the creation of virtual goods and services that exist only in digital form, representing a fundamental shift from all previous cycles focused on physical goods or services. This dynamic is one of the root causes of low to no growth for the developed nations. (See essay at the end).

Labor Transformation

Labor transformation has shown increasing complexity and acceleration across cycles, with skill requirements evolving from simple mechanical operations to continuous learning and adaptation in knowledge work categories. The information cycle has enabled new forms of work organization including remote work and global collaboration that represent fundamental changes in employment relationships.

Financial innovation has paralleled the evolution of technology cycles, with increasingly sophisticated financial instruments and institutions required to support larger scale investments and more complex risk profiles. The information cycle has created new categories of assets and value creation that require entirely new approaches to valuation and investment.

Contemporary Implications and Future Directions

The convergence of previously separate technology platforms into integrated ecosystems creates new categories of cost advantage that amplify the benefits of individual component technologies. Mobile computing, cloud services, artificial intelligence, and IoT sensors are combining to create platforms that enable entirely new categories of applications and services with cost structures fundamentally different from previous technology cycles.

The analysis of disruptive cost curve shifts across five major technology cycles demonstrates that this phenomenon represents one of the most powerful mechanisms of economic and social transformation ever in human history. The consistent pattern of dramatic cost reduction, enabling mass adoption, creating feedback loops that accelerate further improvement and adoption, reveals a fundamental mechanism of economic evolution that transcends specific technologies and time periods.

While the basic pattern remains consistent, the specific mechanisms driving cost reduction have evolved substantially, from mechanical substitution through system optimization to digital convergence and network effects. This evolution suggests that future cost curve shifts may operate through mechanisms that differ significantly from historical examples, requiring new frameworks for recognition and analysis.

But why are we stuck in low/no growth modes in most nations today?

Economic growth has not accelerated as economic theory would predict. Instead, we observe a phenomenon that economists call the “productivity paradox” or “Solow paradox,” named after Nobel laureate Robert Solow’s observation that “you can see the computer age everywhere but in the productivity statistics.” This paradox has only deepened as digital technologies have become more pervasive and powerful.

The democratization of technology has also led to market fragmentation and the proliferation of marginal competitors. While this might seem beneficial from a consumer perspective, it actually reduces overall economic efficiency. Instead of a few large, efficient producers serving a market, we often see hundreds or thousands of small players, each operating at suboptimal scale and duplicating efforts. This fragmentation prevents the realization of economies of scale that historically drove productivity improvements and economic growth.

Digital Technologies

Furthermore, the ease of market entry enabled by digital technologies has created what economists term “excessive entry.” When starting a business requires minimal capital investment and can be accomplished with basic digital tools, markets become oversaturated with competitors. This oversaturation leads to intense price competition that drives profit margins toward zero, leaving little surplus for reinvestment in productivity-enhancing innovations or capacity expansion.

The shift from physical to digital assets has also fundamentally altered the nature of economic value creation. Traditional industries created value through the transformation of physical inputs into more valuable outputs, a process that required substantial capital investment and generated employment for large numbers of workers. Digital businesses, by contrast, often create value through the manipulation of information and the facilitation of connections between existing market participants. While these activities can be valuable, they frequently represent a redistribution of existing value rather than the creation of new value.

Perez has a different theory

Economists like Carlota Perez wrote: “This time, however, things are different. With the current ICT revolution, we seem stuck in what she calls the ‘turning point’, the mid-way time of recessions and uncertainty, revolts and populism that reveals the pain inflicted on society by the initial ‘creative destruction’ process. When the system is in danger and is being questioned and attacked, politicians finally understand they must set up a win-win game between industry and society. This is when the light bulb finally goes on for many businesses. And yet this time, although installation had been as intense as ever, both in jobs and regional destruction and in lifting new areas and whole countries to development, post-bubble crashes have not led to an institutional rethinking to unleash the more productive times of the Information revolution.”

Next – Chapter Three – Codification as Liberation

Below is the Disruptive Cost Curve Shifts listing for the innovations and bibliographies for Disruptions Dawn within the technology cycle library.

Innovation and Bibliography listing Disruptive Cost Curve Shifts

The main entrance to Technology Cycles Main Library – The Singularity Stacks Link

Link to return to Disruptions Dawn menu